Oops!

Now about those tariffs causing inflation and low growth.

Last fall, in one of its endless series of rants against the Trump tariffs, the Wall Street Journal published yet another op-ed on how poor the United States would be without imports.1

The fading newspaper, helplessly caught between woke front page reporters and conformist neocons on the editorial page, thought to add a celebrity twist to the shopworn argument that taxing domestic production is preferable to taxing foreign consumption.

Indeed, by throwing in the likes of Sir Paul McCartney and Shohei Ohtani as poster boys for foreign talent, the authors sought to sweeten the virtue of globalism with a little pop culture and sports prowess.

Now being both a Beatles and an Ohtani fan, I admit the tactic caught my eye—but it (like all the other WSJ tirades) failed to convince.

It may well be that import duties might raise the cost of Sgt. Pepper or a Dodger’s ticket. Then again, it may well be that the billionaire songwriter would be happy to eat the cost in order to gain access to the world’s most lucrative market. Maybe so that he could do another profit-maximizing tour here? One of which he just finished.

Why, I bet he might keep writing great music even if his net worth dropped a few million or so.

Ohtani has already demonstrated his willingness for deferred compensation in his pay package, but if he won’t settle for a few million less, perhaps the ‘importer’ would?2 Of course, that might mean the world-champion Dodgers would drop from the second highest payroll in MLB to the third or fourth. Either way, it seems massively subsidized professional sports teams could afford the duty without passing the costs on to fans.

I bring it up only because the ‘sky is falling’ hysteria came crashing down last week squarely on the heads of the ‘free-trade’ ideologues at the WSJ and elsewhere. For over a year they’ve assured us that the Trump tariffs would cause inflation to surge and the economy to slow—bigly.

Oops.

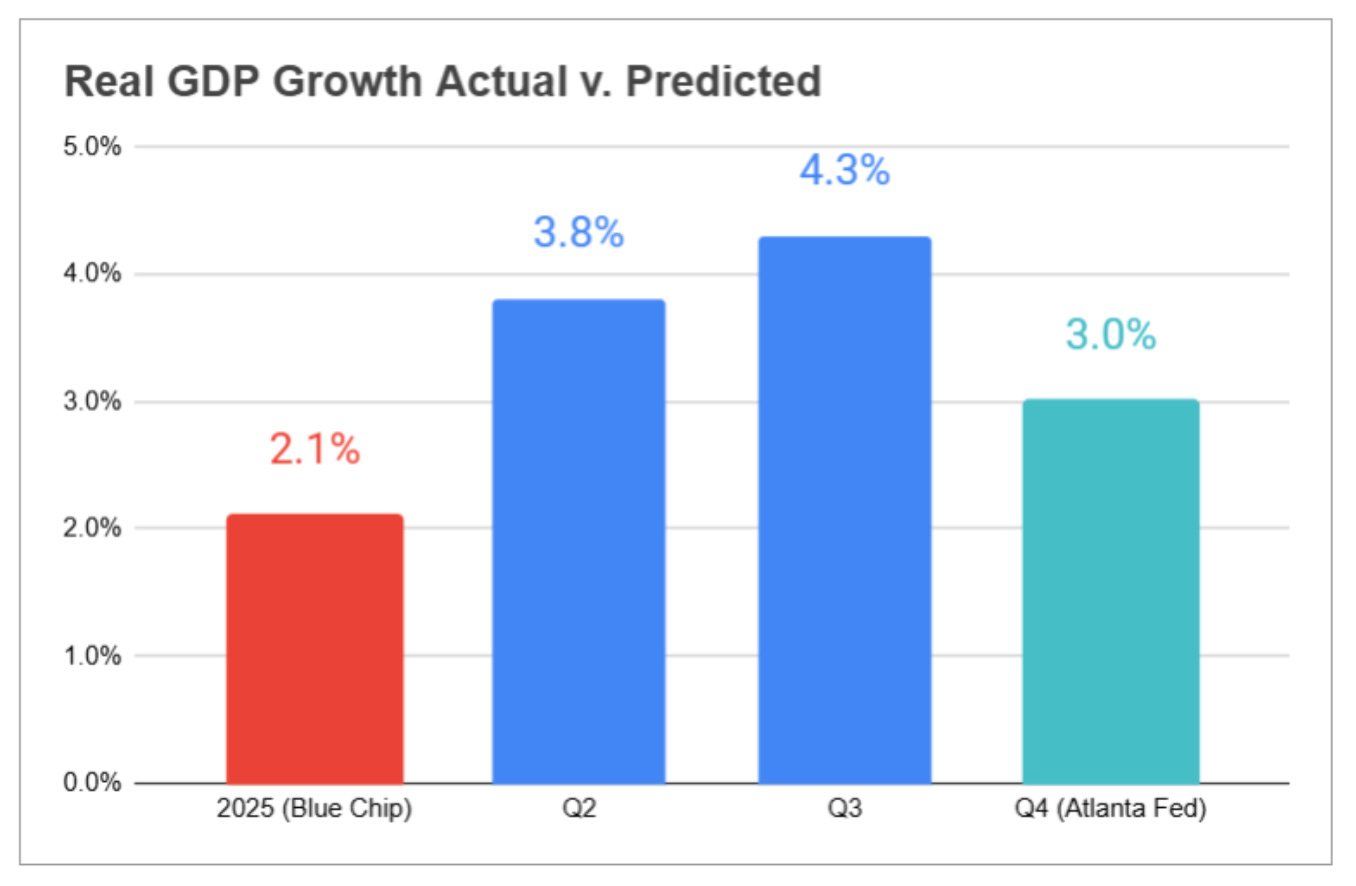

Inflation unexpectedly eased last month to just 2.7% over the last twelve months, according to the latest survey from the Bureau of Labor Statistics.3 Even worse for the ‘any tax but tariff tax’ crowd, was the Commerce Department report showing a 4.3% GDP growth spurt in the third quarter.4

This one-two punch to ‘economists’ and naysayers wasn’t supposed to happen. At least according to the experts who were still clinging to the “tariffs’ most predictable and immediate effects are sputtering growth and declining consumer welfare” line—after the two reports came out.5

In fact, it’s downright fascinating to watch the excuses pile up.

Why, it’s really an AI ‘productivity boom’ that’s behind the robust GDP numbers, not Trumponomics.6 Sounds good, but productivity requires investment and that was supposed to be impossible with all that foreign capital drying up from a smaller trade deficit.7

Subscribers to Jason’s Newsletter have seen our more detailed economic analysis of the trade issue here and here. But pointing out the obvious never gets old.

Tariffs are on the fiscal side of the ledger, not the monetary side. They do not create fiat money and bid up general prices—the way successive rounds of the Fed’s ‘quantitative easing’ did to housing. Import duties may result in a one-time hike in the cost of some foreign goods, but only by reducing demand (hence prices) for home grown products by the amount of the tariff..

Or they may not. As the recent data suggest, importers may find substitutes or even eat the extra cost of duties themselves to keep the aisles full. Foreign manufactures may decide to do the same to keep market share.

A stronger dollar will further push down import prices as demand for foreign currency falls along with the current account deficit.

Finally, using the extra tariff revenue, already prorated at $400 billion annually, to offset income taxes will add to the American worker’s disposable income, making those already exorbitant McCartney and Dodger tickets far more affordable.8

The One, Big, Beautiful Bill, kicking in January, may only be the beginning of a Trump push to use tariff revenue to eliminate the federal income tax.9

Which reminds me, where are all the Club for Growth/Americans for Prosperity supply-side tax cutters on this? Are they so addicted to bailing out overseas multinationals (who already enjoy subsidies from their socialist foreign governments) that they can’t see the potential of zeroing out domestic income taxes?

Perhaps a few of these silly libertarians (like Sen. Rand Paul, who seems particularly bothered that national interest might get in the way of a global utopia that will never come to pass) are just too busy warning consumers that tariffs could raise prices?

Then again, so do sales taxes.

Shall we encourage no-income tax states in the U.S. to give up their consumption levies and reinstate income taxes? Of course not. The point is all taxes distort, but taxes on production distort the most. Regardless, comparative advantage would be a lot easier sell if these knee jerk reactions to tariffs didn’t seem aimed at ‘protecting’ foreign entities that can most afford them.

And that is the elephant in the ‘swamp’s’ living room. A veritable parade of global interests on Capitol Hill intent on keeping things just the way they are. Downward pressure on wages from outsourcing and undocumented labor. Foreign dollars financing big government while America is hollowed out.

It is, over the long term, unsustainable.

Naturally, the anti-America First Republican establishment is desperate to change the subject. Even if it means pulling out the ‘identity politics’ card against the pro-Trump Heritage Foundation, once the grandaddy of conservative think tanks in Washington. For tolerating free-speech, along with Tucker Carlson, Heritage is now deemed to “have been willing to tolerate antisemitism.”10

BLM’s got nothing on these guys.

It’s no doubt a run-up to 2028 when the attacks will really start to ramp up against J.D. Vance, MAGA’s heir apparent. So far, board members are resigning and Heritage fellows are fleeing to former VP Mike Pence’s new pro-Ukraine war and anti-RFK neocon nonprofit.11 Prominent North Carolina activist and donor, Art Pope, has followed suit.12

Profiles in courage they’re not.

https://www.wsj.com/opinion/tariffs-mean-you-pay-more-for-worse-products-e36855cf?st=RCHDdY&reflink=article_copyURL_share

https://sports-entertainment.brooklaw.edu/sports/shohei-ohtanis-hidden-ball-trick-and-the-effects-his-deferred-contract-is-having-on-state-tax-revenue/

https://www.bls.gov/cpi/news.htm

https://www.bea.gov/news/2025/gross-domestic-product-3rd-quarter-2025-initial-estimate-and-corporate-profits

https://www.wsj.com/opinion/everyone-got-tariffs-wrong-not-economists-levies-economy-inflation-5f672204?st=h47jrc&reflink=article_copyURL_share

https://www.wsj.com/opinion/donald-trump-economy-gdp-consumers-artificial-intelligence-productivity-66cb7afe?st=wow9nx&reflink=article_copyURL_share

https://www.whitehouse.gov/articles/2025/12/trump-tariffs-work-trade-deficit-plummets-to-five-year-low/

https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0925.pdf

https://www.newsweek.com/donald-trump-proposes-eliminating-income-tax-11123769

https://www.wsj.com/politics/elections/top-heritage-officials-flee-to-mike-pences-nonprofit-as-think-tank-fractures-28765f2b?st=ibXfvg&reflink=article_copyURL_share

https://www.msn.com/en-us/news/other/top-heritage-officials-flee-to-mike-pence-s-nonprofit-as-think-tank-fractures/ar-AA1SPkao

https://www.wsj.com/opinion/heritage-foundation-staff-exodus-mike-pence-kevin-roberts-c4ba0b7c?st=NFkJ4j&reflink=article_copyURL_share

Interesting take on how the predicted disaster hasn't materialized. The GDP jump to 4.3% is definitly unexpected given all the dire warnings. What caught my attention is the point about importers eating the costs to maintain market share - that's exactly what I've seen with electronics distributors in my area, they absorbed price hikes rather than lose shelf space. The bigger question is whether this holds once companys run out of runway on their margins, but for now the data speaks pretty loud.

Why do Republicans seem so intent on snatching defeat out of the jaws of victory? Good things are happening and 26 looks like a great year economically. Trump may not be perfect, but he’s VERY good!