Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

― John Maynard Keynes, The Economic Consequences of the Peace

In the wake of Silicon Valley Bank’s (SVB) ignominious collapse, Wall Street’s in a twitter (no, not that kind) over who might be next. But the run on SVB was a symptom, not a cause. And it’s nothing new. The expression “not worth a Continental” reveals the problem is as old as the Republic itself.1

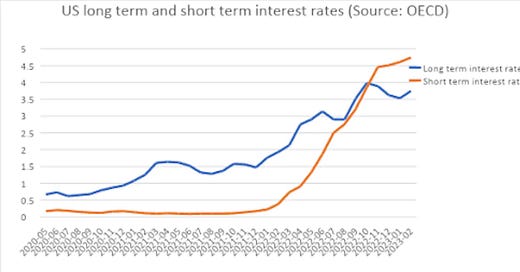

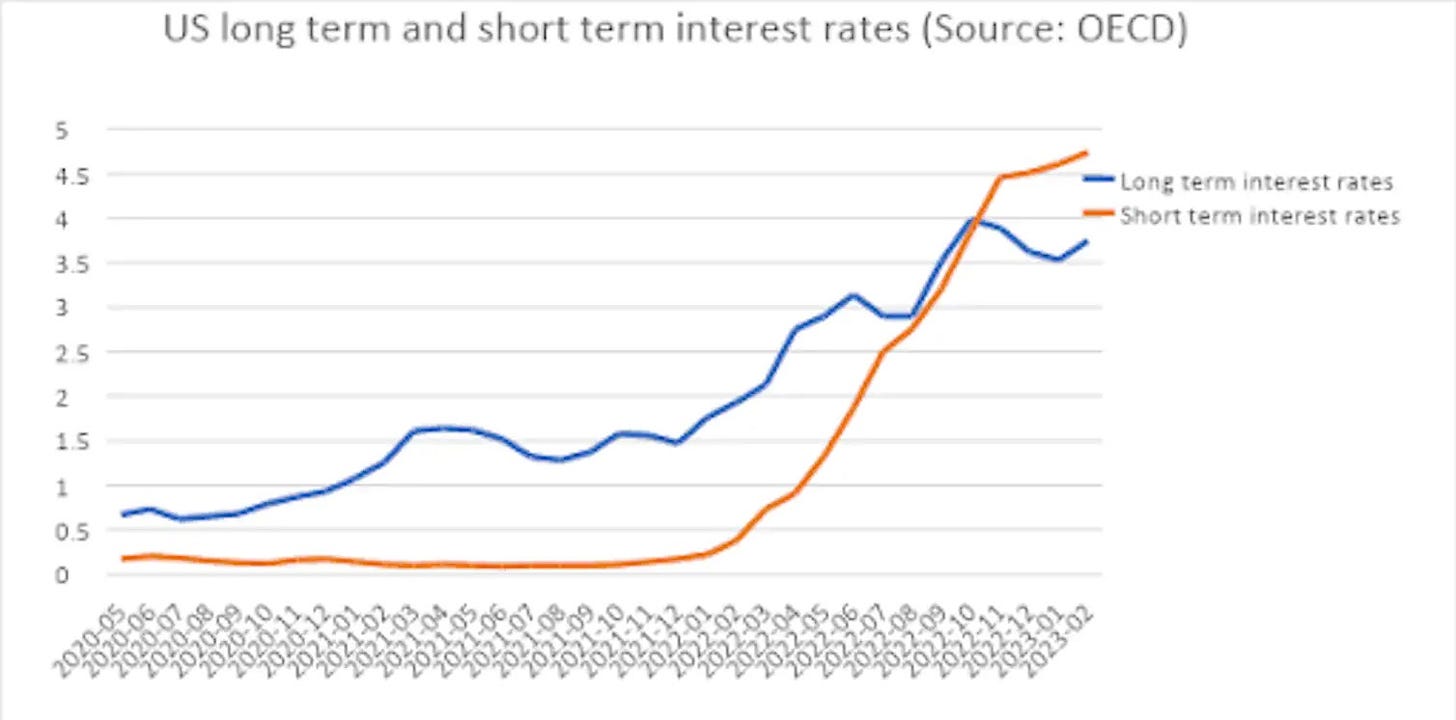

Indeed, the inevitable result of the Federal Reserve’s decades-long low interest rate policy was a predictable stampede of investors and savers speculating on higher yields, or even—in the case Sam Bankman-Fried—a corrupt crypto-currency exchange.

At some point the Fed had to ‘snatch the punch bowl’ before the inflation party got out of hand culminating in a real run on the dollar. So the unwinding of its massive $9 trillion portfolio has begun and anyone holding even the safest of long-term bonds (like SVB) is getting caught in the crossfire as rising yields crater face values.2